This post deals with some of the finer points of using the screener on MagicFormulaInvesting.com. As with many aspects of the strategy the usage seems so simple and straightforward, yet anyone who digs into it will realize there are devils in those details. And there are points I wanted to bring up to generate discussion.

First of all, you have to create an account to use the screener on MagicFormulaInvesting.com, but there is no fee to use the site. I have been using the site for about a year and, true to the claims on the site in the FAQs, it doesn’t seem that Magic Formula Investing (MFI) has shared my email address with any unrelated firms. As far as I can remember I have also never been contacted by other websites owned in part by Joel Greenblatt though the FAQs suggest that I could be.

It would be difficult to make the site any simpler. Here is the user interface:

I leave the Minimum Market Cap at the default value of $50 million because small companies, though more volatile, will also be the ones to experience the most growth. Also, that market cap is what Mr. Greenblatt used for his back-testing, the results of which are presented in exciting detail in The Little Book that Beats the Market.

The Number of Stocks parameter, however, was a head-scratcher. The whole Book is based on the strategy of buying the top 30 stocks as determined by the formula, so why would he even provide this parameter? Well, I think he had to because some of the top 30 stocks that the screener identifies are ones that you might not be comfortable investing in for various reasons, including:

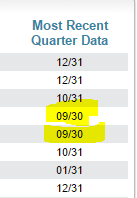

The Company’s Most Recent Quarter Data may seem outdated

Here is a partial screen shot of the last column of the screener results.

This was taken on 3/18/2017, yet for some reason the Most Recent Quarter Data for Avid Technology (AVID) and BP Prudhoe Bay Royalty Trust (BPT) are from 9/30/2017. Different companies release their quarterly data at different times. Nasdaq reports that BPT’s data is due to come out on Monday 3/20/2017 (just a couple days after I’m writing this). This financial data is the basis of the formula rankings. We only hold these stocks for a year, so I’m hesitant to buy a stock now when I know that data that will be released in a couple days could easily throw BPT or AVID out of the screener results altogether. Therefore, I’m hesitant to buy stocks whose Quarter Data is unusually “old”.

Some companies may be too sketchy to invest in

One of the benefits of using a formula for your investment picks is that doing so removes emotional prejudices and other unfounded biases we may have about certain stocks. Regardless of how we feel about the business prospects of Apple or GameStop, the formula forces us to focus purely on financial data and the current stock price.

But…

Some of the companies identified simply don’t pass my sanity check. Getting back to BP Prudhoe Bay Royalty Trust (BPT), according to this article from the Motley Fool, the company may cease to exist as early as 2020. This stock, which appeared in the results of MagicFormulaInvesting.com’s screener at the time of writing, was set up as an investment in the output of a specific oil field in Alaska. Once that oil field is depleted – which could be in just a few years – any shares of stock in the company will be worthless. Now, as formula investors, we won’t hold the stock more than a year, but I would be very uncomfortable investing in this stock, despite the fact that its dividend yield is nearly 14%! Maybe I need to get over it. According to The Book and the site’s FAQs, the screener excludes utilities and certain financial industry stocks. I’m surprised a company like this is fair game.

You may feel Dirty investing in some of these companies

How do you feel about investing in for-profit universities? Or tobacco companies? Weapons manufacturers? Sure, if you own an index fund you probably already indirectly invest in these kind of firms. But many people (including me – depending on my mood) would be uncomfortable purchasing shares of some of the companies identified by the screener.

![]()

For these and other reasons that are the topics of other posts, I often end up selecting that “50” radio button after I’ve run out of stocks in the top 30 that I’m willing to invest in.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.