Hello Magic Formula followers! Since I’ve given up on Joel Greenblatt’s The Little Book that Still Beats the Market in April of last year, I’ve been trying to decide whether it’s worth my time and money to try another strategy, or to forget investing in individual stocks altogether and just double-down on my index funds. In the meantime, I’ve reinvested my MF Portfolio in collection of dividend-paying stocks such as AbbVie, Microsoft, Hershey, Johnson & Johnson, etc. I’ve also given myself the goal of developing my own Formula investing strategy to outperform the market.

I’m considering just about everything but here are some rules:

- No Black Boxes. I have to be able to run the strategy myself. So no subscriptions, including free ones like Greenblatt’s.

- It has to be easy. I’m not going to spend 40 hours a week poring over financial statements. It has to be a formula that works with a stock screener or similar easily available tool. Don’t get me wrong; I’m willing to spend a lot of time researching and developing the strategy itself, but, once complete, it has to be easy to apply – at least as easy as Greenblatt’s.

- Once proven, I must keep it a secret, otherwise it might stop working. So if you notice that my blog suddenly goes dark, it means I’ve arrived at the Secret Formula! I’m only half joking here. In the process of researching simple stock screens that should outperform the market, I kept thinking, if anybody, including I, really had a working formula, why would we take the time to promote it, or even disclose it at all? Wouldn’t you just quietly get rich? Sure, we could sell some books or make money blogging about it, but why risk ruining our working formula?

Andrew’s Magic Formula Screener

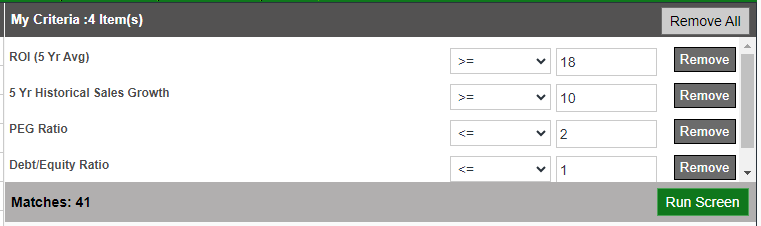

Ever hear of Zacks? It’s a free screener. Just about every online brokerage has a screener too, but I like Zacks the best so far due to the combination of available parameters and ease of use. Here are the four criteria in my Magic Formula:

First, I have ROI, Return on Investment, aka Return on Invested Capital (ROIC). To quote Invesopedia’s succinct definition, ROIC “assesses a company’s efficiency in allocating capital to profitable investments.” A higher value is better and the thing I like about Zacks is that they have a 5 year average ROIC. I would like a seven year average even better, but several screeners I looked at don’t even have a 5-year. Averages are better, because every company will have good years and bad; it’s best to look at several recent years of data. An 18% ROIC is very high, and means the company is really good at turning investments into profits. Please check out this really interesting video on the late, great Charlie Munger’s thoughts on ROIC. Next is 5 Year Historical Sales Growth. Again, I like the fact that it’s an average of several years. Sales is one of the key determinants of profitability, so I want to see strong sales growth. The PEG Ratio is my only valuation ratio. It screens out stocks that are too expense but doesn’t penalize stocks with high P/E Ratios as long as they also have a high growth rate. Finally, insisting on a Debt/Equity ratio less than 1 screens out companies with too much debt.

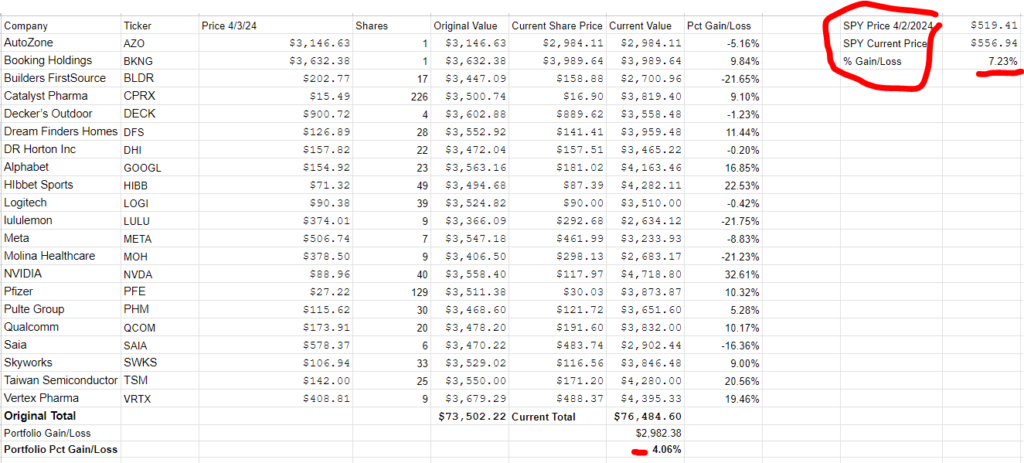

How did I choose these four? I did some research on the different ratios and screening criteria, and these are the ones I decided would be the best indicators of quality companies that aren’t crazy expensive. If you think you’ve found some better criteria for a screener I would love to hear about it – please leave a comment! You see in the screen shot that, as of 7/17/2024, 41 stocks pass my criteria. This is a few more than back in April when only 35 made the grade. That’s not many out of thousands of stocks in the various exchanges. I further weeded out a few more; I think some had very lumpy, irregular sales or growth or I just didn’t believe in the companies for some reason. Anyway, my final number of companies in my Magic Formula Portfolio is 21:

I didn’t actually buy these stocks. This is a test of the screener. I won’t actually eat my own cooking until I believe it’s better than the SPY. But I recorded their prices on April 2nd and “bought” similar amounts of each one. The strategy is to hold each stock for a year. If the stock still passes the screen at the end of the year, I’ll continue to hold for another year, without rebalancing. If it doesn’t pass the screen, I’ll “sell” and reallocate to companies that do pass. Just like last time, I’m comparing my portfolio’s performance to that of the SPY, whose price I recorded on that same date. And just like last time, I’m losing (again!) to the SPY. BUT I’m doing better than Greenblatt’s formula. The plan is to re-evaluate at the one-year mark, run the screener again. I’ll sell any stock that no longer passes the screen, and keep the ones that do without rebalancing the ones that have out-performed (one thing I’ve learned over the years is “Let your winners win”).

Why is it so hard to Beat the Market?

I think my screener should be killing the S&P 500, but the SPY up over 16% year-to-date. The thing is, the index is being propped up by a handful of companies (NVDA, META, AMZN, LLY, MSFT). Is an AI bubble partly responsible? I think so. The other thing is, though, the stocks that outperform either are very hard to predict or just don’t make sense. For example, did you even know that Abercrombie & Fitch was a publicly traded company? If ANF passed my screener, at first glance I’d probably say, “Nah, how did that dog pass the screen? Must be a fluke!” But ANF stock is up 328% in the last 12 months! Yes, 328%! How is that possible? I don’t know, their sales have been beating expectations or something. Who would have guessed? They still don’t come close to passing my screen.

What’s your strategy to beat the market? Please let me know in the comments. Don’t worry, your secret will be safe with me! Also, I’m looking for recommendations for screeners and back testing services.

Hey there.

I first found your blog about 3 years ago. And today I decided to check out how is your journey. I am glad you gave up on this idea of that formula. But thank you for keeping this blog.

I, same as you, was exited after reading the book. But as usual, I decided to check real-life applications. After that I decided ‘thanks but no thanks’.

Since you are asking about alternatives, you may want to check this: https://www.portfolio123.com/e-book/how-i-made-a-million-bucks-with-portfolio123.pdf

He explains why traditional screeners fail and proposes an alternative. It worked for him quite well.

However, at the moment he is underwater YTD (he says that is the worst result in several years of using his method), so buyer beware 🙂

Anyways. That link is a marketing material, but he is a real guy, I’ve been following his progress periodically since 2019. He is also present on Seekingalpha if you are interested.

Thanks again and good luck 🙂

Hi Mike,

I have heard about Portfolio123. In fact, I have an account! I was interested in using it for back testing. I’ve never really used my account though because I think you have to pay a decent monthly fee for their back testing service. There’s a learning curve to using it and I question how good the data actually is. Greenblatt claims he used back testing too. The problem with these services is, they don’t give details on how it works. In Real Life, publicly-traded companies go bankrupt, and they get bought by other companies. Do these back testing service account for that, or do they only include companies that are still around and that didn’t go bankrupt or disappear via a merger? I would still consider using backtests to develop a strategy, but I need more compelling info before I dig in on it.

Thanks!

andrew

I’ll tell you a secret:

Investment universe: top 2000 largest American companies, excluding REITs and SPACs.

Buy the top 10 companies that have had the highest stock price increases in the last 5 months;

Example: purchase date 2023-12-30, check the percentage change of these 2000 companies from 2023-07-29 to 2023-12-29 and buy the top 10 performers.

Hold for 1 year;

Repeat the process.

It also works with returns from the last 6 months.

Be careful because it will be very volatile; it’s best to check just once a year or invest a small amount of money.

Hi Mota! Interesting. Which screener do you use to find these? And how did you learn about this strategy?

Thanks,

andrew