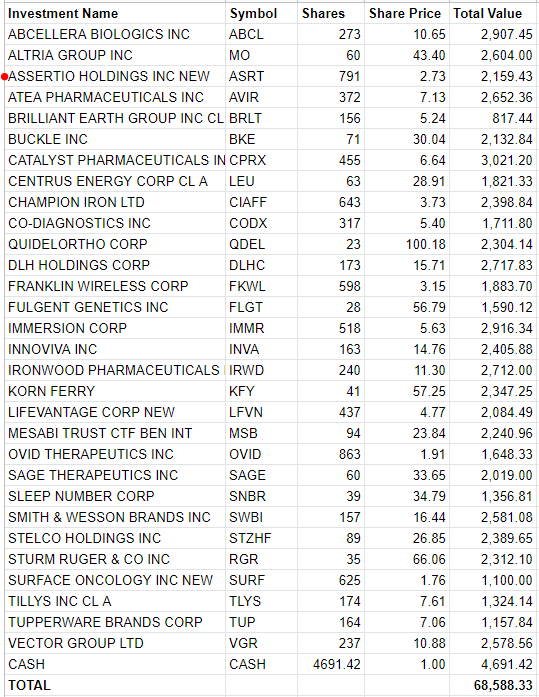

Hello ladies and germs; it’s time for another update of my Magic Portfolio performance. This update comes just after I replaced H&R Block (HRB), which I sold for nice profit, with Assertio Holdings (ASRT), chosen using my Random MF Stock Picker:

The portfolio is losing more ground to the S&P 500 Index. My Portfolio’s total return since inception over five years ago is only just over 14%, while the S&P 500’s return, not including dividends, is up over 68% during that same time frame. This is counter-intuitive. The Magic Formula stocks are supposed to be all about value investing. In these times of higher volatility and possible recession when the S&P 500 index is down more than 18% for the year, one would think the stocks identified by Mr. Greenblatt’s screener would be holding their own vs. an index. But, in the Afterward to the 2010 edition of The Little Book that Still Beats the Market, Greenblatt writes on page 161 “Over the last 22 years, when comparing the performance of the magic formula portfolios during up months for the S&P 500 and down months for the same index, it turns out that much of the outperformance of our portfolios comes during the up months”. Greenblatt goes on to say “Most people would expect value stocks (mainly because they are already considered cheap when purchased) to hold up much better in down markets and perhaps underperform a bit in up markets“. Greenblatt doesn’t have a good answer for why this has been happening but writes “I can only speculate that since the Magic Formula is heavily earnings based, during down markets investors sense less protection from a company’s high recent earnings than from high levels of assets or sales.” Huh?

Note that there is nearly $4,700 in cash in the portfolio. Every time I sell a MF stock I rebalance the stock by replacing it with another MF stock worth as close as I can get to 1/30 of the total portfolio value. When selling stocks at an outsized profit (such as H&R Block, which I just sold), this method of rebalancing leaves some money on the table. But this is necessary, because when I sell an underperformer such as BRLT or SURF I need to tap into those cash reserves or I wouldn’t be able to buy roughly equal amounts of every stock.

Good luck, stay tuned, and keep in touch!

You seem to have a relatively outsized position in biotech/pharma… Based on my reading and your documented experience it seems the magic formula has not been doing well lately. I wonder if the industry/sector makeup of the bucket of stocks fitting the criteria has changed over time…In other words, are there just more small bio/pharma companies now than existed in the past when the formula was outperforming? And does that bio/pharma just not perform as well?

Hi Alex,

The outsized position in biotech/pharma in my portfolio is because there are a lot of biotech/pharma stocks on MagicFormulaInvesting.com. Every one of my stocks was randomly chosen from those on Greenblatt’s website. You ask an interesting question: “are there just more small bio/pharma companies now than existed in the past when the formula was outperforming?”.

Greenblatt makes a lot of claims in his book about outperformance but he did not publish the actual companies his research selected, so who knows if there were more or less of them from 1988 to 2010, which is the years he looked at to make his claims of outperformance. You’re not the first to ask about biotech/pharma. Another reader has suggesting tweaking the strategy in The Book to exclude these, but if I did that and still underperformed the market, then readers could correctly claim, “your Formula Investing experience is invalid because you didn’t follow the strategy in the book!”

Thanks for reading,

andrew

Hi Andrew, Can you provide another update? It has been almost 6 months since your last update in June.

Hello Bob,

Ask and you shall receive! I just posted another update. I meant to do so this weekend, but your comment reminded me, so thanks!

andrew